Codexal AML — Anti-Money Laundering

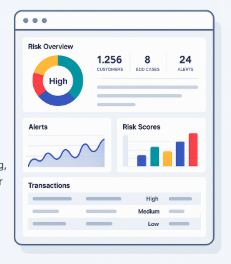

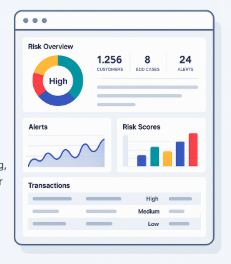

A comprehensive AML platform to identify, assess, and mitigate risks: onboarding/KYC, customer risk scoring, transaction monitoring, Enhanced Due Diligence (EDD), cross-border compliance, visual dashboards, and audit-ready reporting.

Meet Regulatory Requirements

Stay compliant with local and global AML regulations with built-in controls and reporting.

Reduce False Positives

Efficient rules and risk models reduce noise so teams focus on real threats.

Avoid Fines & Penalties

Strengthen controls to protect your reputation and minimize regulatory exposure.

Mitigate Risks in Real-Time

Monitor transactions and behaviors continuously to prevent suspicious activity.

Key Features

Risk Identification & Assessment

Advanced analytics and profiling to surface vulnerabilities early and prioritize remediation.

Mitigation & Control Mechanisms

Automated workflows, real-time alerts, and case management to reduce exposure to financial crime.

Compliance & Reporting

Audit-ready reports, evidence trails, and dashboards aligned with regulatory frameworks.

Enhanced Due Diligence (EDD)

Deep onboarding and ongoing reviews for high-risk entities with configurable checklists.

Cross-Border Compliance

Support for multi-jurisdiction requirements to serve global operations consistently.

Data Visualization & Insights

Clear charts and KPIs to drive decisions and demonstrate program effectiveness.

Why choose Codexal for AML?

- Comprehensive: All AML pillars in one platform, from KYC to reporting.

- Cutting-edge: Continuously updated rules, models, and integrations.

- User-centric: Simple, intuitive UI for compliance and business teams.

Need help?

Technical Support: Troubleshooting and best-practice guidance.

Product Support: Feature walkthroughs and adoption help.

Resources: FAQ and knowledge base for quick answers.

Ready to see it live?

Talk to our team and explore how Codexal AML fits your compliance program.

- Phone: (+962) 06 582 4373

- Email: info@codexal.co

- Location: 6th Circle, Amman, Jordan